The Bank of Canada maintained its overnight rate at 4.5 per cent at their last meeting on Wednesday. In the statement accompanying the decision the Bank noted that demand in Canada still exceeds supply and labour markets remain tight and that first quarter economic growth looks stronger than expected. However, the bank expects consumption growth to slow this year as households renew mortgages at higher rates and growth in exports and investment will decline as the US economy slows substantially in coming months. On inflation, the Bank expects headline CPI inflation to fall to 3 per cent in the middle of this year before declining gradually to 2 per cent by the end of 2024. However, the Bank warned getting inflation back to 2 per cent will be challenging given still high inflation expectations, elevated service sector prices and strong wage growth.

Real Estate Statistics

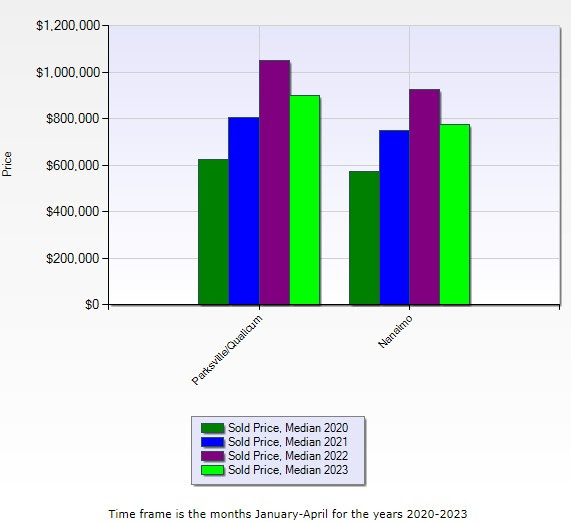

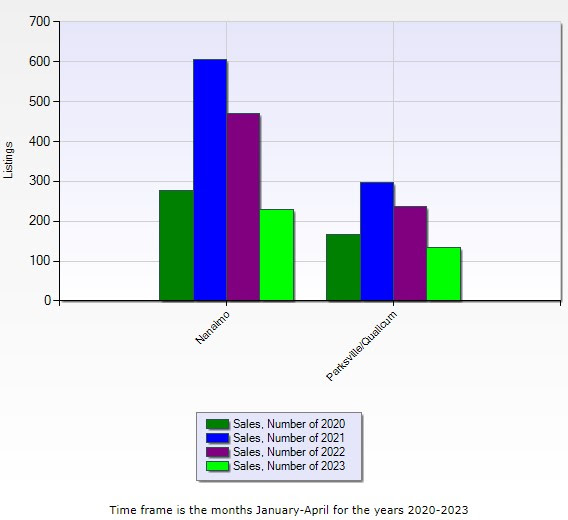

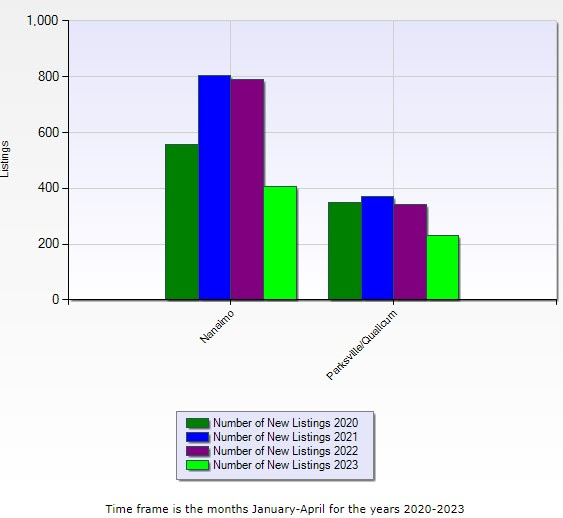

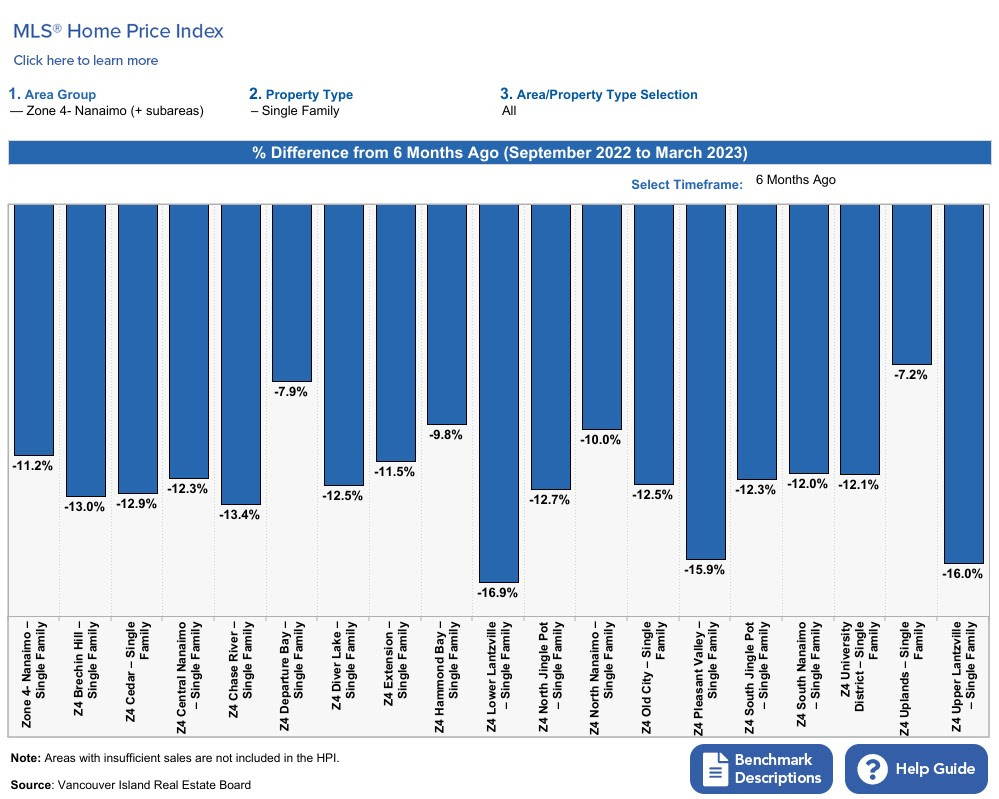

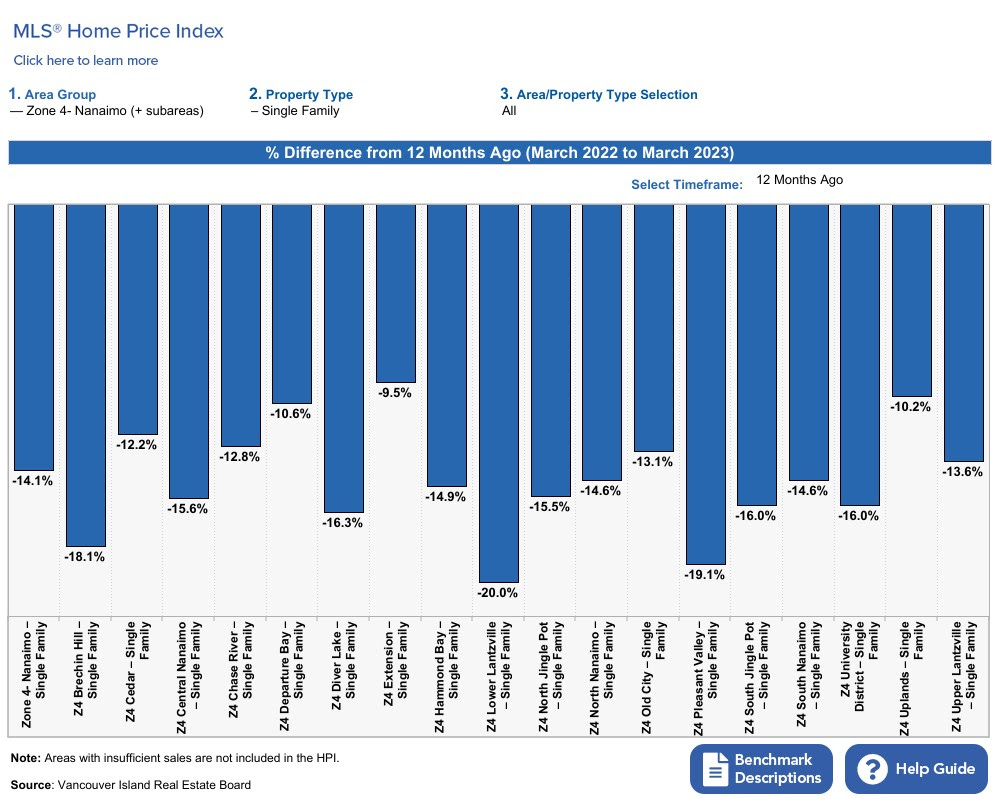

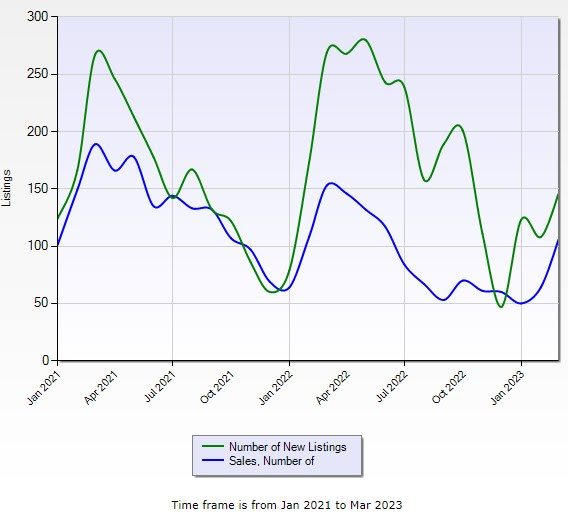

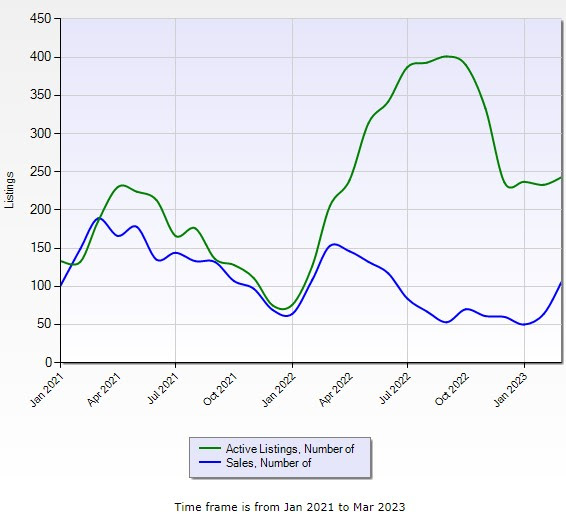

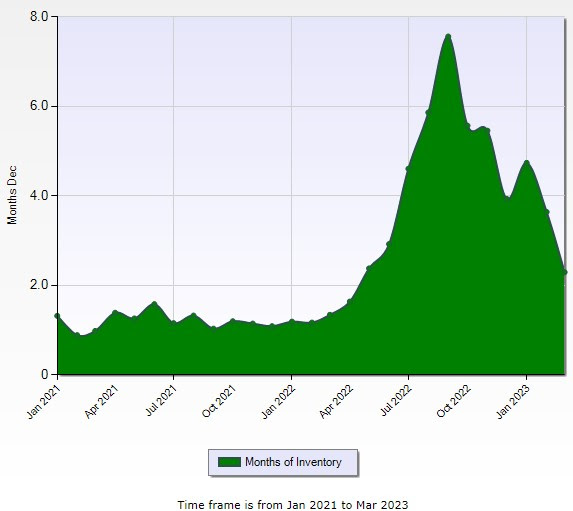

The graphs below show the median sold price, sold numbers and number of new listings since the beginning of each year (freehold homes only.)

Median Sold Price:

These figures do concentrate on single family homes but if you would like similar information for other property types, such as apartments or patio homes, or specific geographical areas of Nanaimo or Parksville/Qualicum, then I would be more than happy to discuss those with you as well.

As always I hope you find these monthly newsletters informative and if at any time you or any of your friends, relatives or co-workers are looking for a professional realtor to help them buy or sell a home, or just have a real estate question, please call my personal cell, 250-739-1228, or drop me an email.

Thank you,

Ian

Comments:

Post Your Comment: