The Bank of Canada maintained its overnight rate at 4.5 per cent at its last meeting on March 8th. In the statement accompanying the decision, the Bank noted that restrictive monetary policy is weighing on demand and it expects weak economic growth for the next couple of quarters. That weak growth should moderate wage growth in a currently tight labour market and ease competitive pressures on prices, ultimately leading to inflation reaching 3 per cent by the middle of 2023. As for the possibility of future rate increases, the Bank stated that it will continue to assess economic developments and the impact of past interest rate increases and is prepared to increase its policy rate further if needed.

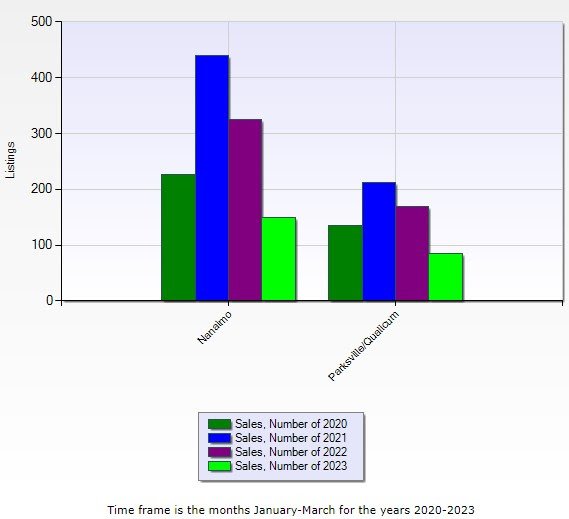

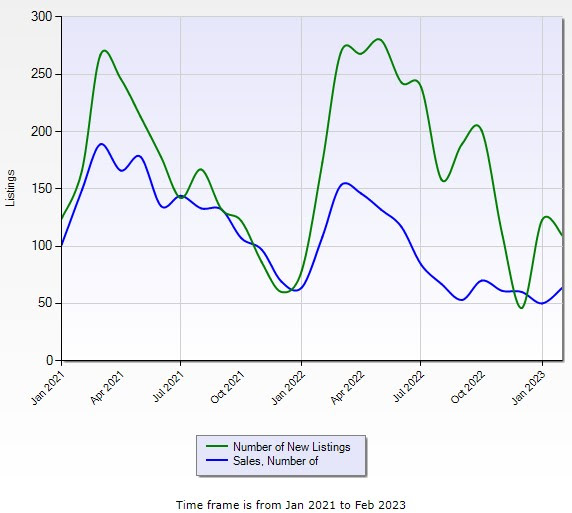

These high interest rates has led to a slowdown in the real estate market and we are continuing to see that in the figures/charts as shown below. Prices are close to where they were for 2021 (although higher in Parksville/Qualicum), sales are lower then we have seen for the past few years but also new listings are down, although the total inventory level is higher. I do get asked quite often where prices are heading and unfortunately without a crystal ball it is very difficult to predict. If interest rates go up again than I think prices will drop further but currently we are seeing fewer sales but also fewer new listings so this could keep prices steady. We would normally expect to see an increase in sellers listing their homes for sale as we transition into spring but if the buyers are still elusive then this is likely to push prices further down. If we start to see more buyers looking but sellers reluctant to list their homes than this is likely to see prices stay steady.

As you can see there are so many factors that can affect the market but the driving force has been higher inflation causing higher interest rates and until we see that settle and then start to come down we are likely to have a much slower real estate market.

Real Estate Statistics

Synopsis for Nanaimo

The graphs below show the median sold price, sold numbers and number of new listings since the beginning of each year (freehold homes only.)

Median Sold Price:

Sold Numbers:

Number of new listings:

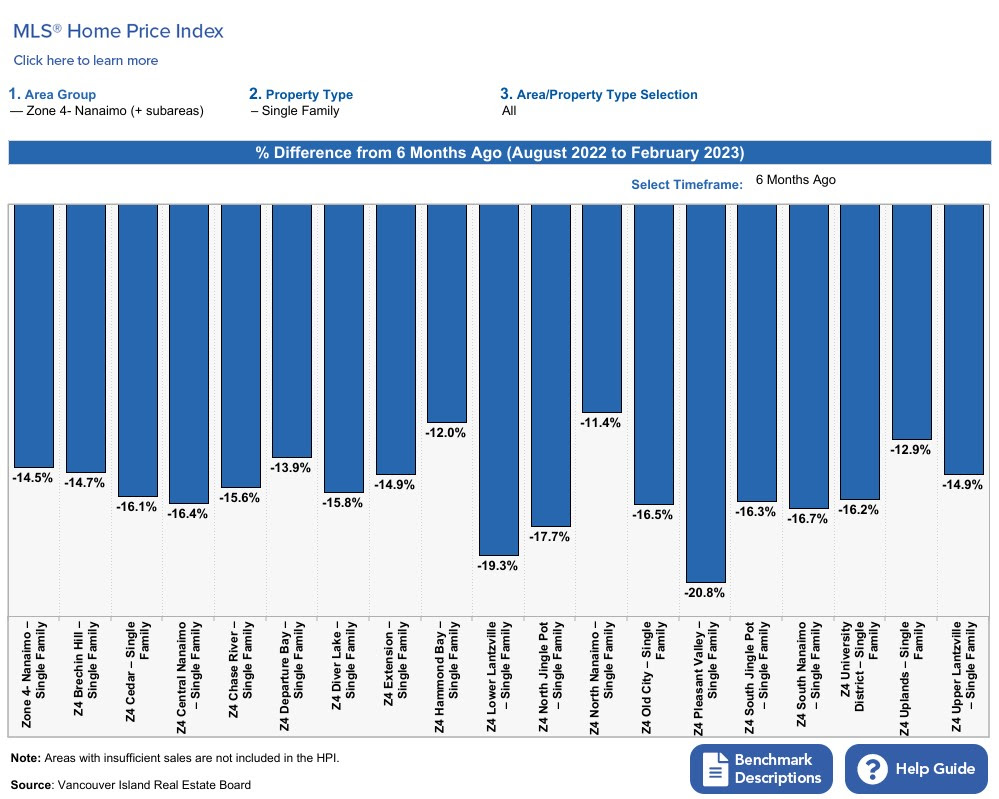

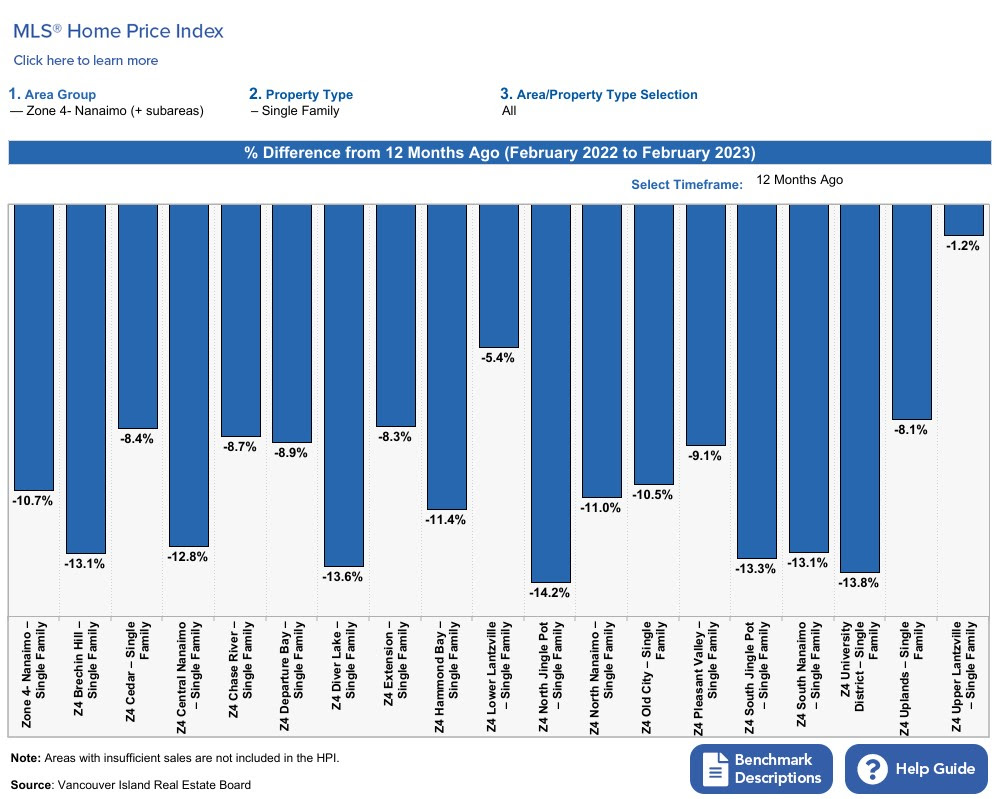

The following graphs shows the % difference of the housing price index (HPI) from the same month 6 and 12 months ago. It is split into the different sub-areas (the overall figure for Nanaimo is on the left of the graph) and is for single family homes.

The following graphs are for Nanaimo and show the sales numbers against new listings and sales numbers against total active listings. This is helpful to show how the market is doing as the closer the 2 lines come together on each graph generally indicates a busy active market.

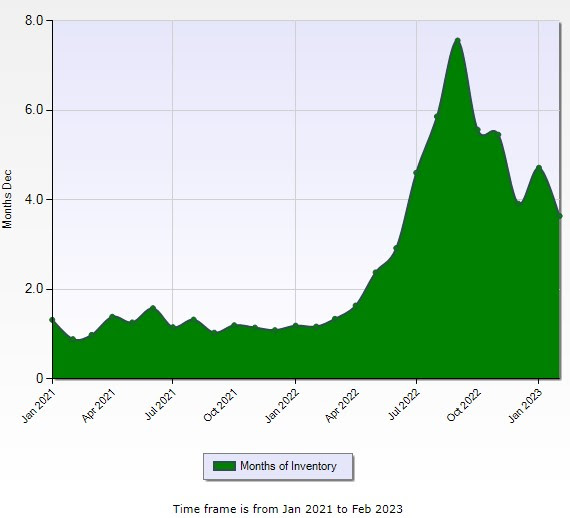

The following graph is for Nanaimo and shows the months of inventory. This is the time it would take the current freehold, single family homes for sale, to sell, if no new homes were listed, which indicates whether we have a sellers, balanced or buyers’ market.

As always I hope you find these monthly newsletters informative and if at any time you or any of your friends, relatives or co-workers are looking for a professional realtor to help them buy or sell a home, or just have a real estate question, please call my personal cell, 250-739-1228, or drop me an email.

Thank you,

Ian

Comments:

Post Your Comment: